What are the benefits of creating some of these accounts as ‘Bank Accounts’ instead of being ‘normal accounts’?

Each ‘Bank Account’ has its own dashboard page charting the running balance and a breakdown of receipts/payments/transfers in & out during the period, and various quick links

- Bank reconciliations – reconcile against cheque / deposit entries to see what’s outstanding at year end

You can upload the statement data just as it is per account, then quickly match transfers between the ‘Bank Accounts’ (without causing a double-up on the transaction entry in the general ledger)

The statement data feeds to the General Ledger but is still a separate report in itself, thus allowing cheque/deposit matching and inter-bank transfer matching to work nice & smoothly

You can split receipt or payment transactions (you can’t do this in manual journal entries)

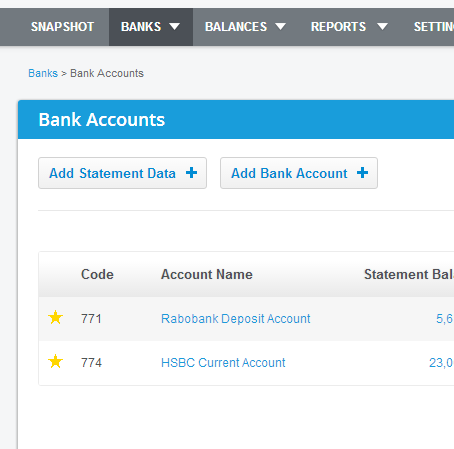

You can ‘favourite’ (☆) these accounts for quick access from the main menu